Do Businesses Pocked the Cash?

There's a common misconception among consumers, sometimes echoed by the media, that stores, restaurants, and other businesses prefer when customers do not redeem their gift cards. This belief stems from the idea that merchants get to keep the money from gift card purchases without having to deliver merchandise or services in return. For example, if a gift card to a local bakery goes unused, the bakery keeps both the dollars and the donuts.

However, the reality is a little more complex.

To fully unravel this misconception, I'll explain the different types of gift cards, varying state laws that govern their use, and how merchants can actually earn more than the face value of a gift card when it is redeemed.

Looping In: Two Main Types of Gift Cards

To clarify how businesses make money from gift cards, I first need to explain that there are two primary types of gift cards. The key to understanding each one lies in the "loop"—a term that refers to the range of acceptance and redemption of the card as follows:

Open-Loop Gift Cards:

Bank-issued gift cards are called "open loop" because they can be used widely—essentially, anywhere the card’s payment network (like Visa, MasterCard, or American Express) is accepted. This wide range makes the loop "open" because the card isn't limited to a single retailer or location; it circulates money broadly across different merchants, much like a debit or credit card.

Closed-Loop Gift Cards:

Conversely, store or restaurant gift cards are "closed loop" cards because they must be used at specific retailers or locations. The loop is "closed" because the card circulates money only within the particular retailer’s ecosystem, keeping the financial exchange confined to a single business or a defined group of affiliated companies.

The "loop" metaphor effectively describes how money moves within these systems—either flowing across an open network or circulating within a closed, controlled environment.

Now, if you're new to my explanations on gift card intricacies, let me set the stage: As a consumer guide to gift cards, I aim to highlight the essential points you need to know, steering clear of overly technical details and exceptions. While we could dig deeper into the many differences between open- and closed-loop gift cards, my focus today is on debunking the common myth that businesses with closed-loop systems prefer when gift cards go unredeemed. So, with that in mind, let's move on to gift card laws.

Navigating Federal and State Gift Card Laws

Gift card laws vary significantly, especially when comparing open-loop to closed-loop gift cards. The regulations that most influence how businesses profit from gift cards revolve around four key areas: fees, expiration dates, escheatment, and the requirement to cash out remaining balances. Before we explore each to understand their impact, let’s discuss the interplay between federal and state gift card laws.

Oh, hey—you can read the full disclaimer below, but I want to stress that I'm just a consumer who has been paying close attention to the gift card industry for over a decade and trying to understand the nuances myself. Nothing in the gift card industry is more confusing to me than the gap between federal and state gift card laws, with 50 different interpretations of the rules. But I understand enough to share these highlights—which are less telling than the "day in the life of a gift card user" section that will convince you of what I already know—that stores and restaurants would rather you use your gift cards than not.

But let's keep going.

The CARD Act of 2009

The Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 sets the federal baseline for gift card protections. Here are the key provisions of the CARD Act that pertain to gift cards:

- Expiration Dates: Gift cards must remain valid for at least five years from the date of issuance or the last date funds were added. This rule ensures consumers have ample time to use their gift cards.

- Fees: The Act restricts gift card fees by allowing only one inactivity fee per month after a card has gone unused for at least one year, and the card's terms clearly state potential fees.

- Promotional Gift Cards Excluded: It's important to note that promotional gift cards, often given away for free as part of a promotional or loyalty program, are not covered under the CARD Act. These cards can have different terms, including shorter expiration dates and fees.

However, these federal laws serve as a minimum standard.

States can and often do enact laws that provide additional protections for consumers. (Here's a great recap of state gift card laws.) When state laws offer greater protection to consumers than federal laws, the state laws take precedence. For example:

- Some states extend the expiration date well beyond five years or prohibit expiration dates and fees altogether.

- Certain states also have specific laws regarding escheatment (the process of turning over unclaimed gift card balances to the state) and cash-out policies, which dictate that businesses must allow consumers to cash out the remaining balance on a gift card if it falls below a specific threshold.

Understanding federal and state regulations is crucial for businesses to comply with the applicable laws while maximizing profitability. Consumers also benefit from knowing these protections, which help them make the most of their gift cards.

Now, let’s dive deeper into the specific areas of gift card regulations and their implications for those unused cards.

OR, if you’re thinking, 'Enough with the legal stuff, get to the fun part!' then feel free to skip ahead to where I reveal how one gift card led to 5x the spending, multiple in-store and online visits, and much more. (Trust me, it’s way more entertaining.) But for those who love the nitty-gritty details, let’s get to it.

Shout out to the Panda Express employee who handed me a free soda cup after I bought the gift card. THAT's an instant reward.

Regulations that Determine Profitability from Unused Cards

To grasp how businesses financially benefit from unused gift cards, we must explore four key regulatory areas: fees, expiration, cash-out requirements, and escheatment. Each of these factors plays out differently between open-loop and closed-loop gift cards:

Fees

- Open-Loop Cards: These cards, often issued by banks or financial institutions, can include activation fees, monthly inactivity fees after one year of non-use, and reload fees. These fees represent significant revenue streams for the issuers, particularly if the card remains unused after activation.

- Closed-Loop Cards: Typically, these cards do not (or cannot) incur activation or monthly inactivity fees. Issued by specific stores or chains, their primary purpose is to encourage gifting and spending at the merchant’s locations.

Expiration

- Open-Loop Cards: These cards must comply with the federal CARD Act, which mandates a minimum five-year expiration period. Unused funds may eventually expire, allowing the issuer to retain these balances post-expiration.

- Closed-Loop Cards: Many businesses have eliminated expiration dates to simplify compliance across states and encourage redemption. This strategy prioritizes sales and customer engagement over short-term gains from unclaimed funds.

Cash-Out Requirements

- Open-Loop Cards: Generally, there are no requirements for these cards to cash out small balances, which means if a consumer leaves a small amount on a card, it remains with the issuer.

- Closed-Loop Cards: Some states require that if a gift card balance falls below a certain threshold (e.g., $10), the business must offer to cash out the remaining balance. Lawmakers added this regulation to help consumers fully utilize the funds loaded onto a gift card.

Escheatment

Buckle up for this last one.

- Open-Loop Cards: These cards are subject to state laws, which may require issuers to escheat (give) unclaimed card balances to the state after a period of inactivity--depending on where the card was sold and the issuer’s location. Issuers track "breakage," or the expected amount of gift cards that will not be redeemed, and can report this as revenue until state laws mandate turning it over.

- Closed-Loop Cards: Handling unclaimed funds in closed-loop cards is generally more straightforward, as these funds typically revert to the merchant after a certain period unless specified otherwise by state law. Companies use historical data to predict the likelihood of gift card redemption, allowing them to recognize breakage as revenue if it seems the holders will not use their cards. However, businesses must prepare to escheat these funds if required by law. While retaining these unspent balances can result in profit, merchants often prefer the assured revenue from actual sales.

NOTE: Some businesses strategically relocate their gift card operations to states with favorable laws that allow them to retain unspent gift card balances. Furthermore, the effectiveness of escheating funds for consumer benefit can be complex, given that gift cards are typically anonymous. This anonymity makes it challenging for states to return escheated funds directly to the consumer who purchased the gift card, thereby somewhat complicating the intended consumer protection aspect of escheatment laws.

Super clear, right?

Reality Check

Let's be honest.

Merchants want the best of both worlds—encouraging customers to redeem their gift cards, which often leads to overspending and fosters customer loyalty while also benefiting from the funds of those who don’t redeem. However, with state laws increasingly targeting the recovery of unused gift card balances (breakage), forward-thinking brands prioritize strategies that motivate customers to use their gift cards. This approach complies with legal standards and enhances customer engagement and satisfaction, driving repeat business essential for long-term success.

Are you ready for the fun part?

Whether you've diligently followed all the technical details or just skimmed for the highlights, let's move on to a personal example illustrating how businesses benefit more when you redeem your gift cards. But a heads up—I'll throw a quiz at the end to see if you come to the same conclusion that I did. 🙂

The REAL Return on Gift Cards

Here's my story.

In the video at the top of the page, I shared a recent experience purchasing a Panda Express gift card. The exceptional service I received during the transaction perfectly illustrated a positive customer touchpoint. Let me share another experience with more detail. (Don't forget...there is a quiz coming.)

As part of my journey to certify Ulta's gift card experience, I bought two $50 Ulta Beauty gift cards. After that, I returned to the store with one gift card for a makeup consultation, hoping to refresh my look without the risk of choosing the wrong products. Not only did I enjoy the makeover, but I also purchased the recommended products worth nearly 4x the gift card's value.

I reserved the second gift card to explore Ulta's online redemption process. Since the store had run out of the recommended eyeliner, I ordered the product at Ulta.com using the second gift card. After ordering the eyeliner, I still had funds left on the card, which came in handy when my son asked for a new face wash a week later. Opting for convenience and savings, I used the remaining balance to order online with in-store pickup.

I didn't go to the store that day just to pick up the face wash; I also wanted to scope out potential hair services, since I’m new to the area and looking for a regular stylist. I met with Bryanna (the same beauty professional who did my makeup), and felt confident enough to book a hair appointment. Thanks to my recent purchases, I had accumulated $30 in Ulta loyalty rewards, which I redeemed during my hair service. I even scheduled my next appointment.

Are you ready for the quiz?

Gift Card Quiz

Question 1: How many touchpoints did I have with Ulta?

Or should I say, how many opportunities did Ulta have to engage with me?

Answer: I had at least seven interactions with Ulta, each creating opportunities for engagement and service as follows:

- Buying two $50 gift cards

- Using one gift card in the store for a makeup consultation and purchasing recommended products

- Using one gift card to buy eyeliner online

- Ordering face wash online with the remaining balance

- Picking up the face wash in-store and booking a hair appointment

- Attending the hair appointment and using loyalty points

- Scheduling the next hair appointment

This list does not include using the Ulta Beauty app, receiving the eyeliner by mail, getting email updates on my appointments and orders, and getting regular updates through Ulta's newsletters and physical flyers. These subtle touchpoints further enhanced my overall customer experience, increasing my connection to Ulta. Plus, I took three people with me—my mom, sister-in-law, and niece—during the initial visit. My sister-in-law, who typically does not visit beauty stores, sought help finding a product, and my niece made a few purchases of her own. That's a lot of potential touchpoints.

Question 2: How much money did I ultimately spend at Ulta?

Answer: My total spending at Ulta was approximately $580, including the cost of two gift cards, makeup consultation, products purchased in-store, eyeliner and face wash ordered online, a hair appointment, and a tip for service--minus $30 in loyalty rewards.

How did you do?

Do you see why gift card redemption might be more valuable to stores and restaurants than merely keeping the breakage? Each redemption potentially leads to additional purchases and boosts customer loyalty and engagement through exceptional customer service, product samples, direct mail, and digital communications. The cumulative benefits of these interactions significantly surpass the possible gains from unspent gift cards.

Moreover, it's crucial to recognize that I could have gotten these products and services at other salons or retailers. Yet, I turned to Ulta time and time again because I held gift cards for Ulta.

With that perspective in mind, I'd like to discuss one more point regarding the broader impact of gift card practices.

Are Merchants Doing Enough to Woo Gift Card Holders?

When it comes to closed-loop gift cards, merchants have a substantial opportunity to encourage gift card use. This suggestion goes beyond simply offering gift cards—stores and restaurants should actively engage and incentivize customers to use their gift cards, boosting customer satisfaction and redemption rates.

Consider my experience at Ulta: I decided to purchase and use the gift cards without any direct encouragement from the store. Although the service was exceptional, Ulta did not push me to purchase or use the gift cards. Considering how much I ended up spending—far beyond the value of the gift cards—it's clear that encouraging gift card usage can be extremely profitable for businesses.

With this in mind, here are a few strategic approaches that could make a meaningful difference in how merchants engage gift card holders:

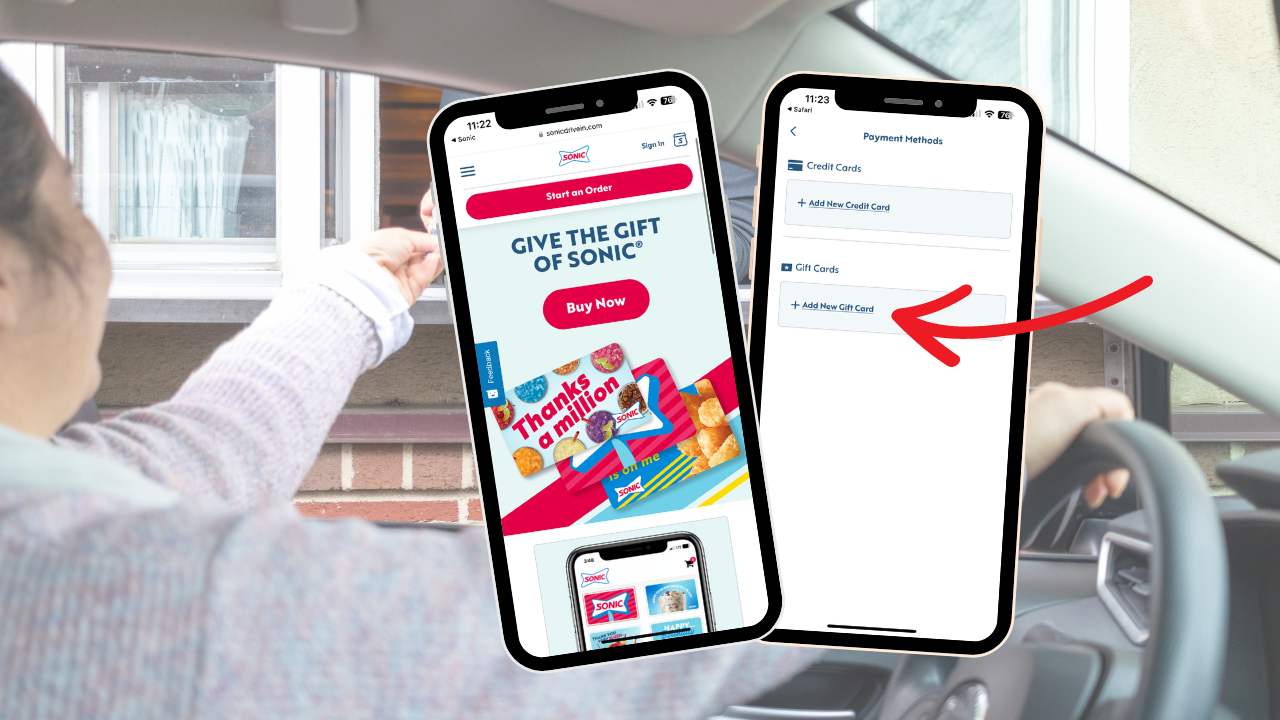

- Integration with Store Wallets: Merchants should enable customers to add gift cards directly into their store wallet apps. This functionality secures the gift cards and integrates them within the merchant's digital ecosystem for customer convenience. A prime example of this is the Sonic App. Users can buy, send, and manage their gift cards all within the app, making them easy to remember and convenient to use. If the tech team is busy with other priorities, merchants should explore EZGiftCard--a mobile wallet that does more than just store gift cards for consumers.

- Usage Reminders at Checkout: Following Amazon's lead, merchants could remind customers at checkout if they have gift card balances available. This simple prompt can significantly increase the likelihood of gift card redemption.

- Offer Discounts When Paying with a Gift Card: At Target, customers using their Target Circle Card receive a 5% discount on purchases, including when buying gift cards. However, if a customer chooses to pay with a Target gift card, they forfeit the 5% discount they would otherwise earn with the Target Circle Card--causing loyal customers to miss out on the savings they generally enjoy. Conversely, Macy's enhances the customer experience by allowing credit card holders to access discounts and rewards even when they pay with a Macy's gift card. Whether part of a loyalty program or not, offering a discount when paying with a gift card is an excellent incentive for use.

- Proactive Reminders: For known gift card holders, such as those with e-gift cards or cards registered to an app, sending targeted reminders can be effective. For example, suggesting customers use their gift cards during special sales or seasonal promotions could prompt more timely redemptions and fewer lost or forgotten gift cards. Additionally, a well-timed reminder could influence the decision to use a gift card at a specific store when customers can buy the same product at other retailers--like happened to me when I chose to buy the face wash at Ulta.

- Regular Incentives and Seasonal Promotions: Merchants should offer gift card redemption incentives during key shopping periods. Special discounts or bonuses during the annual "Use Your Gift Card Weekend" in January can effectively capitalize on the surge of gift cards received during the holidays. Expanding beyond January, I'd love additional promotions during tax-free weekends, back-to-school season, spring sales, and more. These targeted efforts can boost online and in-store traffic while encouraging customers to make the most of their gift cards during critical retail periods.

What other incentives would motivate you to use your gift cards? Is there something specific that would prompt you to pull that card out of your wallet or retrieve it from your email to finally put it to use? Share your thoughts and suggestions below and help us explore new ways to enhance the gift card experience.

Wrapping It Up: The True Value of Gift Cards

The value of gift cards can extend far beyond the mere act of giving. Like my Ulta story demonstrates, businesses win when customers use their gift cards, not just from direct spending but also from the multiple touchpoints and engagement opportunities they create. And customers win when they feel valued and rewarded for giving and receiving your gift cards. I promise.

Quick question: Are you a retailer or restaurateur looking to enhance your gift card program? This blog is an example of the extra-detailed coverage I offer on certified gift cards. But you have to get certified for me to learn the ins and outs of your program.

Let's collaborate to make sure your gift cards create the most positive gift card experiences possible.

Until then, thank you for joining me on this deep dive into the world of gift cards. Remember, every gift card has potential; it's up to businesses and consumers alike to unlock it.

Happy gifting!

Shelley Hunter, Consumer Guide to Gift Cards

0 comments